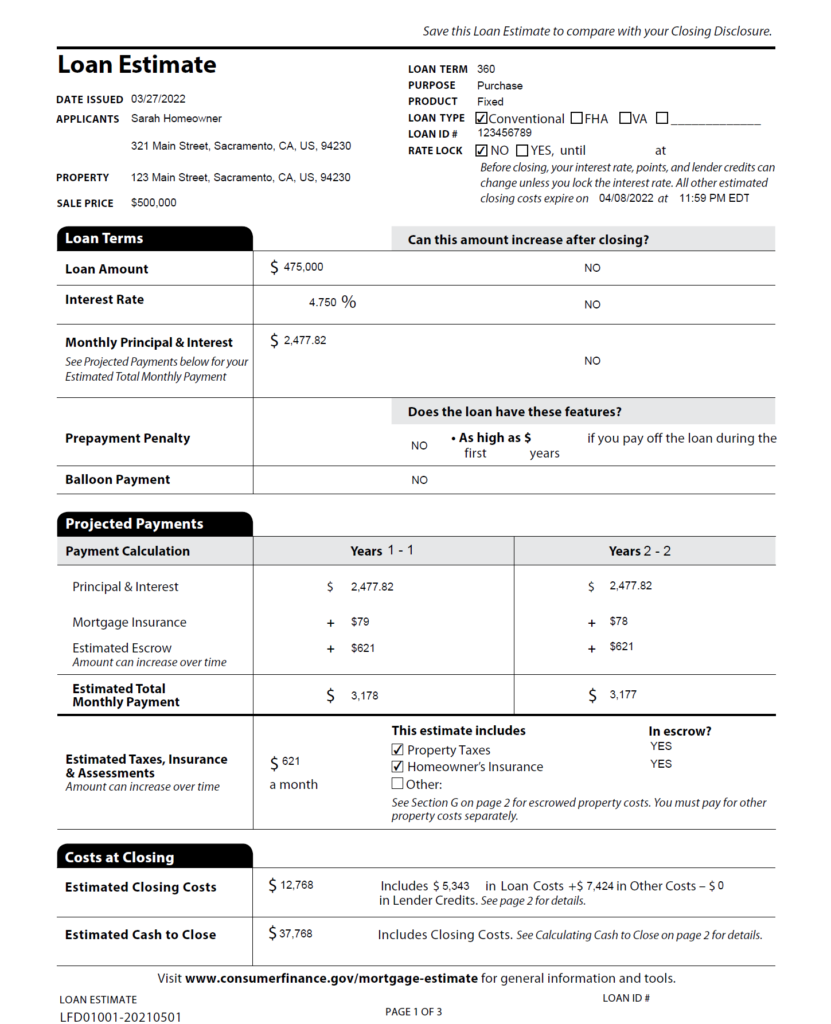

Understanding the Loan Estimate

Reviewing Disclosures?

Learn How to Read the Loan Estimate

Your loan estimate is the first disclosure you will receive outlining the terms of your loan. It will show:

- Your interest rate and whether it is locked

- The type of loan you’ve applied for (loan term, conventional/FHA/VA)

- Whether your rate is fixed for the life of the loan or adjustable

- Your monthly payment, including principal, interest, mortgage insurance, taxes, insurance

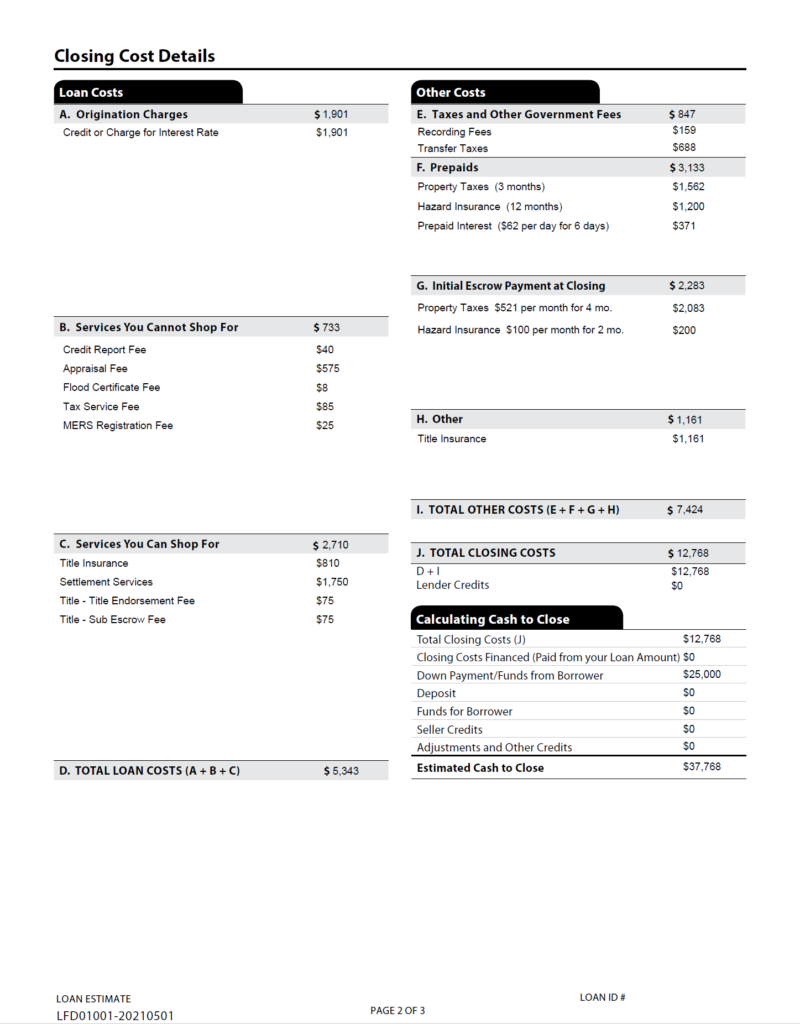

- Estimated lender and third party closing costs

- Whether you’re paying discount points to buy down your rate

- Whether your property taxes and homeowner’s insurance will be included in your payment

- Your estimated cash needed to bring to closing, OR

- The estimated proceeds you will receive back from the loan at closing.

This is your purchase price in a sales transaction, or estimated property value on a refinance. Your loan-to-value ratio (LTV) will be based on this amount.

Important information about the type of loan you've applied for, the number of monthly installments to pay it back, and whether your rate is fixed or adjustable.

Notice which box is checked next to Rate Lock. "No" means your interest rate and the cost for the rate in Box A on page 2 can change. "Yes" means your interest rate is locked until the date indicated.

This section tells you whether property taxes and insurance are included in your monthly payment.

If you've selected to pay points for a lower rate, you'll see the charge here.

If you'll be paying into an escrow account each month to cover your annual property taxes and insurance, several months are collected upfront to fund your account.

On purchase loans, homeowner's insurance will need to be prepaid for one year.

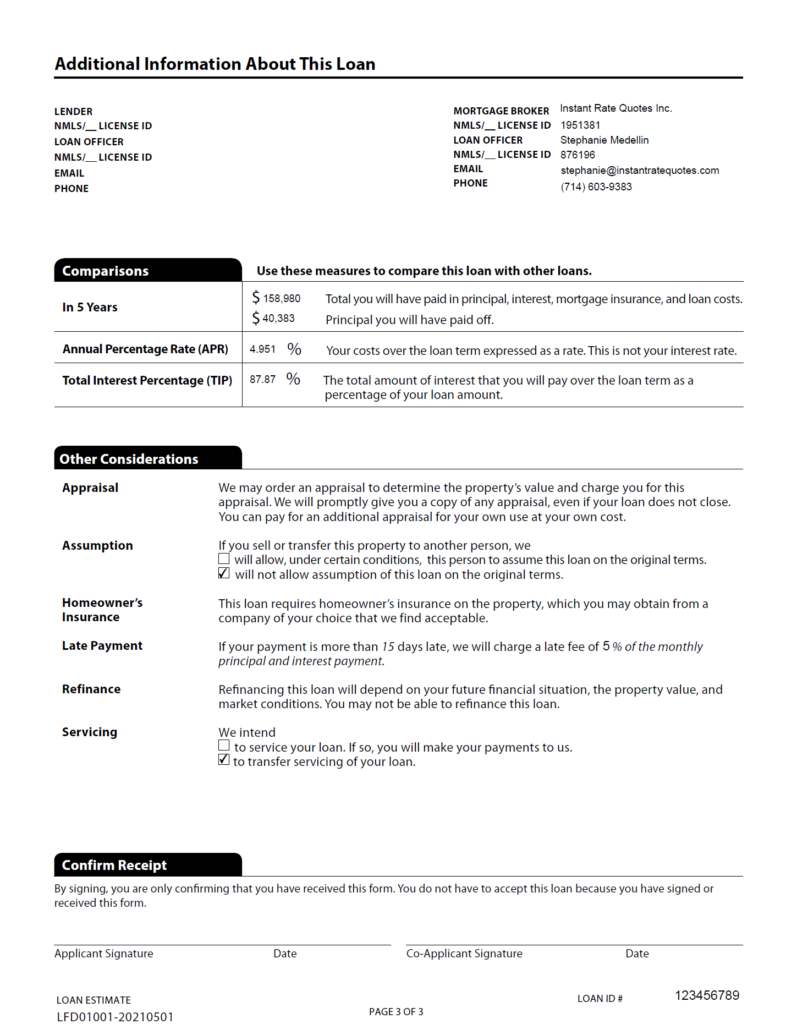

This section shows where you'll be after 5 years.

Some loan types, such as FHA and VA, will allow a new buyer to "assume" your loan, or put it into their name, if they qualify.

This section tells you how much you will pay for a late fee if your payment is late. Many loans have a grace period.

If a lender transfers the servicing of your loan, you will be notified to make your payments to a different company after closing.