Understanding the Closing Disclosure

Reviewing Disclosures?

Learn How to Read Your Closing Disclosure

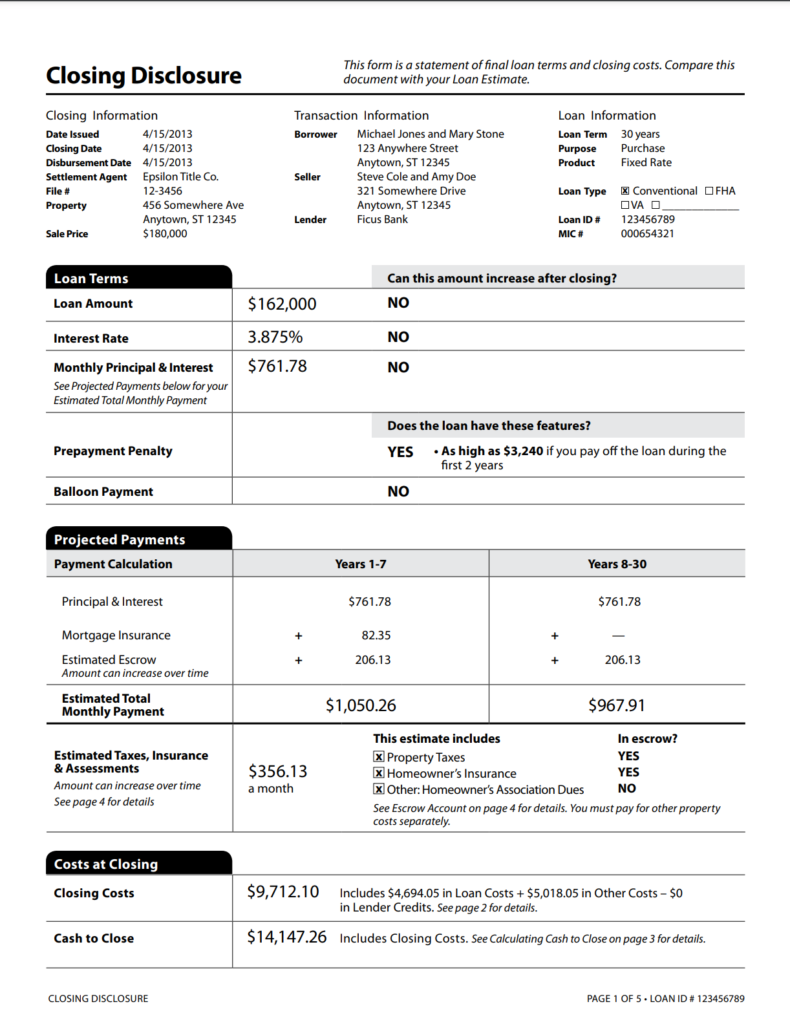

Your closing disclosure will be issued closer to your closing date, and will provide you with an updated summary of the terms of your loan, your closing costs, and your cash to close. You may receive several copies of the closing disclosure if any terms or fees change. It will show:

- Your interest rate

- The type of loan you’ve applied for (loan term, conventional/FHA/VA)

- Whether your rate is fixed for the life of the loan or adjustable

- Your monthly payment, including principal, interest, mortgage insurance, taxes, insurance

- Estimated lender and third party closing costs

- Whether you’re paying discount points to buy down your rate

- Whether your property taxes and homeowner’s insurance will be included in your payment

- Your estimated cash needed to bring to closing, OR

- The estimated proceeds you will receive back from the loan at closing.

This is your purchase price, or the amount you've agreed to pay for the property.

You can verify the length of your loan term here, and whether your interest rate will be fixed.

This section shows your monthly payment with mortgage insurance (if applicable).

This is the estimated amount of money you'll need to bring to closing, including your down payment and closing costs.

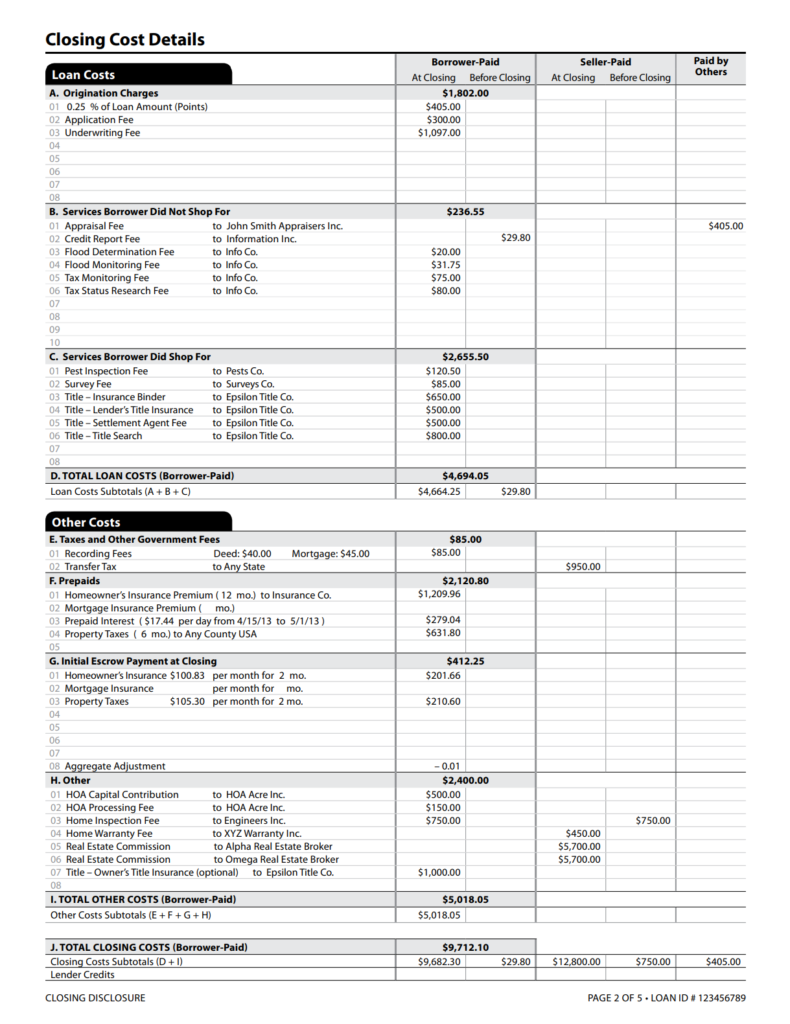

The sum of lender origination charges will be in this section.

Any lender credits would be shown on this line. Typically you either have points in section A, or a lender credit in section J, but not both.

If you paid any fees out of pocket prior to closing, they will appear in the "Borrower Paid Before Closing" column.

Most third party fees are shown in sections B and C, including title and escrow fees.

Homeowner's insurance needs to be prepaid for one year at closing.

Prepaid interest is paid from the date of closing to the end of the month. Number of days will vary depending on your closing date.

Property taxes will only be listed in the "Prepaids" section if a tax bill is due.

Section G will show the number of months of taxes and insurance to be collected upfront for your escrow or impound account.

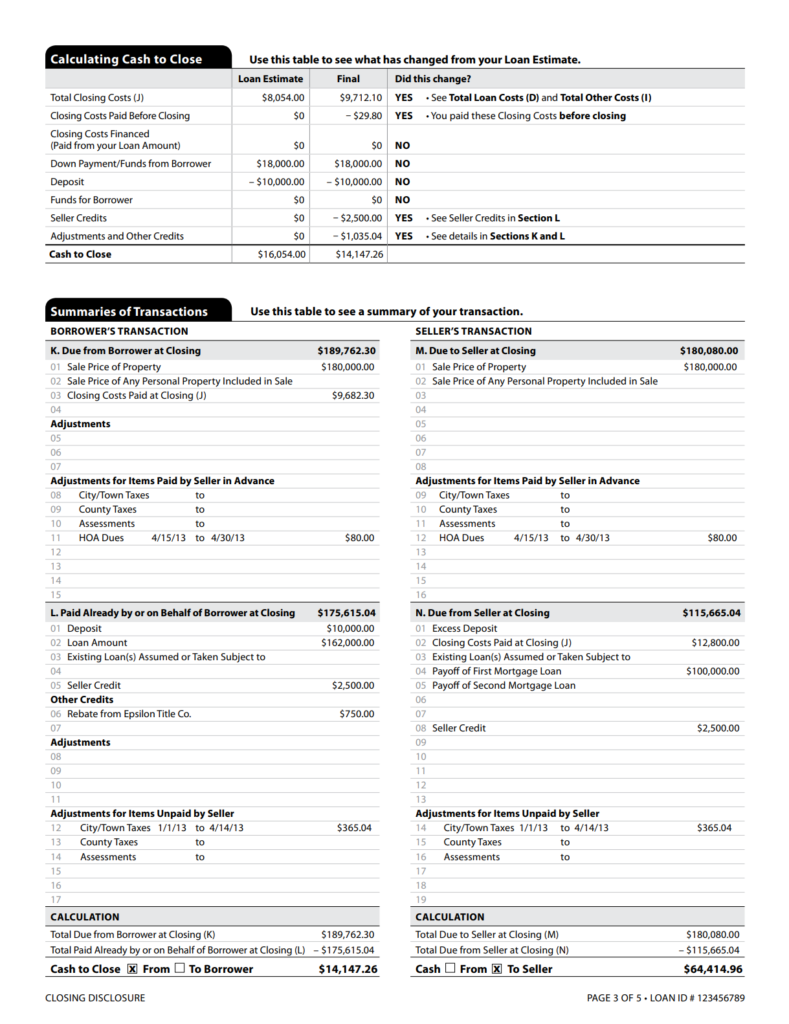

The deposit is the earnest money deposit in escrow, which is credited toward your purchase price and cash to close.

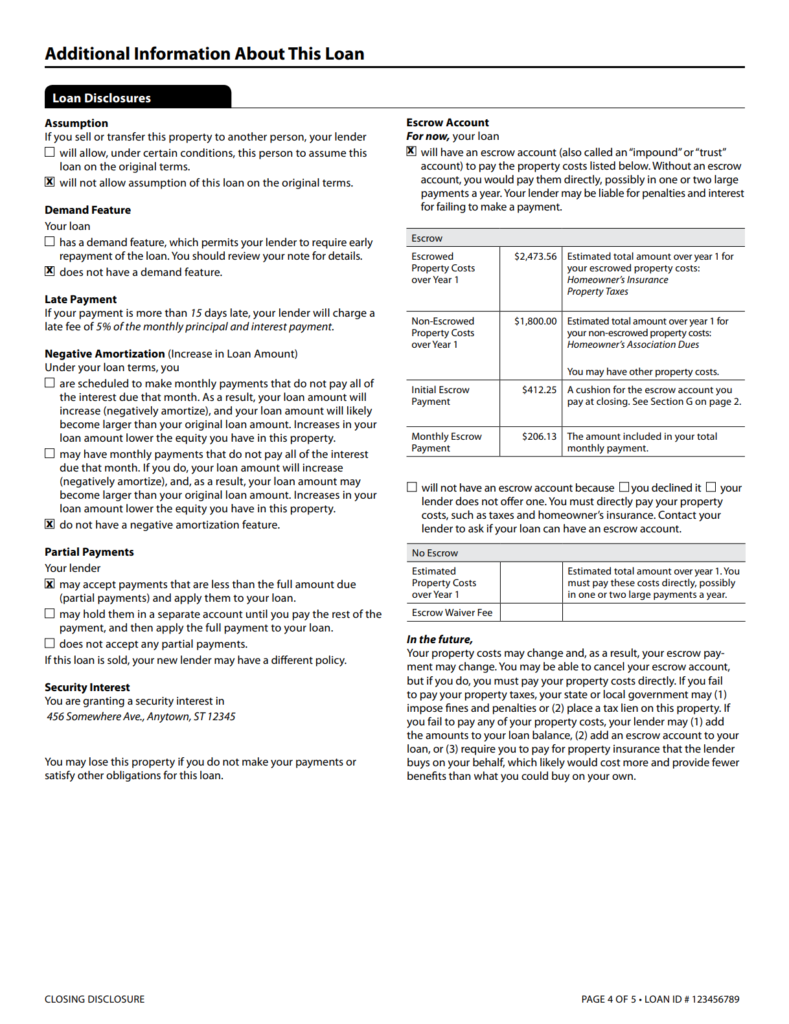

Standard warning to make sure you're happy with these terms, since you may not be able to refinance in the future.

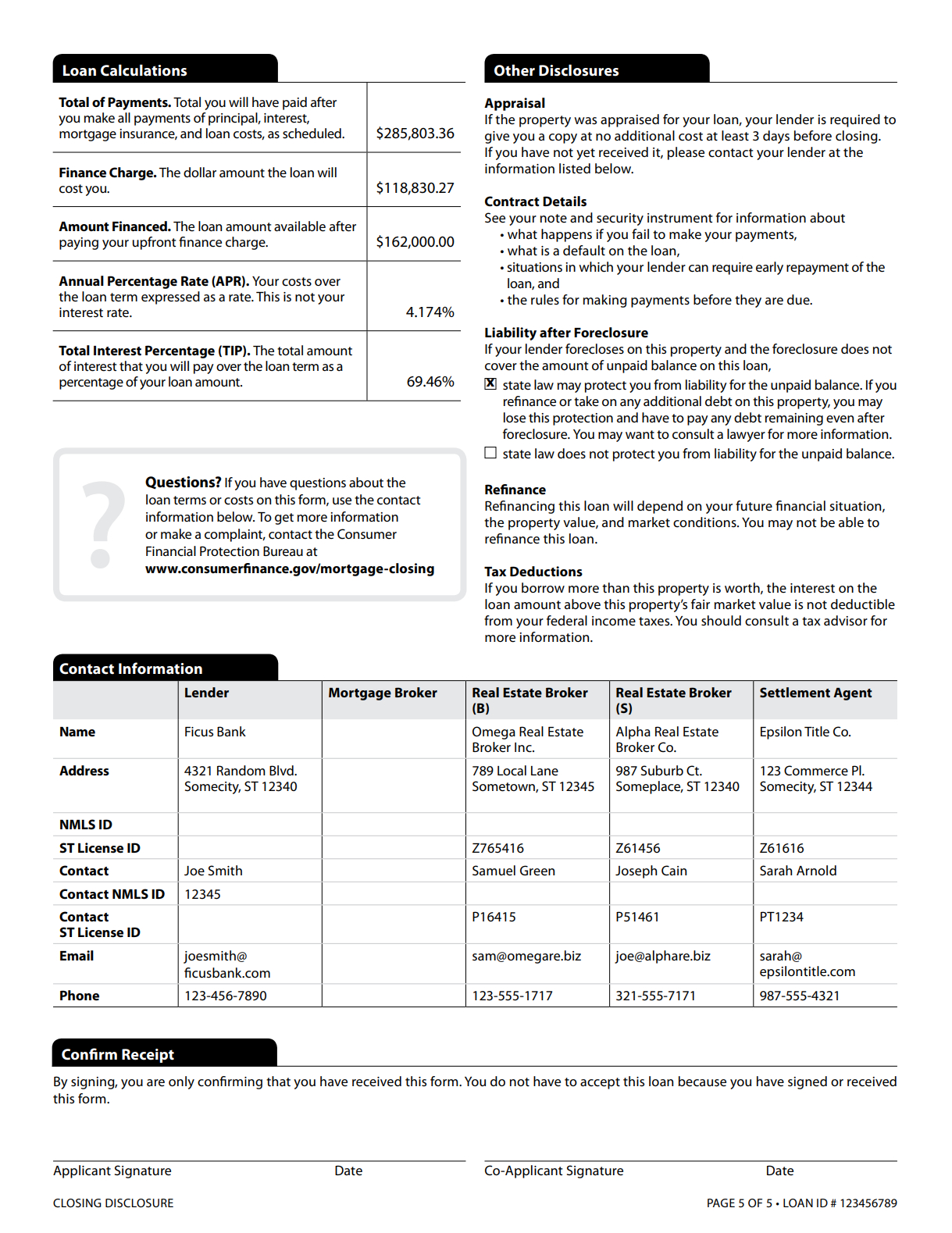

These are all of the companies involved in your transaction. Instant Rate Quotes Inc. will be listed in the mortgage broker column.