100% Financing with Rural USDA Loans

The USDA loan guarantee program helps lower and moderate income home buyers afford a home in a rural area. This program is an incredible opportunity and incentive for people to live in more rural areas of California. It also helps those who already live in those areas to stay and become homeowners. Rural areas typically have fewer options for renting, and therefore purchasing a home usually makes more sense.

USDA loans are only available as 30 year fixed rate loans, and only to people who will live in the home as their primary residence. This is not a program for investors, and the property cannot be income producing. This means only single unit homes (detached single family homes, attached single family homes, condos, PUDs, and even manufactured or modular homes are eligible. There are also no set acreage limits, but the site must not have income-producing land that will be used principally for income producing purposes. Vacant land or properties used

primarily for agricultural, farming, or commercial enterprise are ineligible.

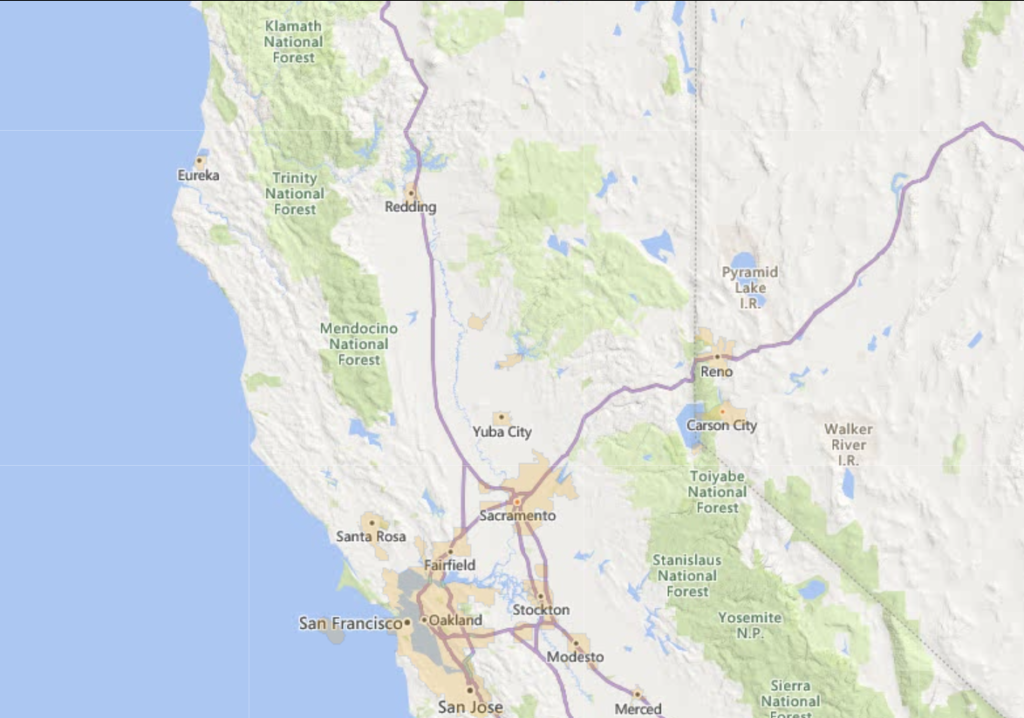

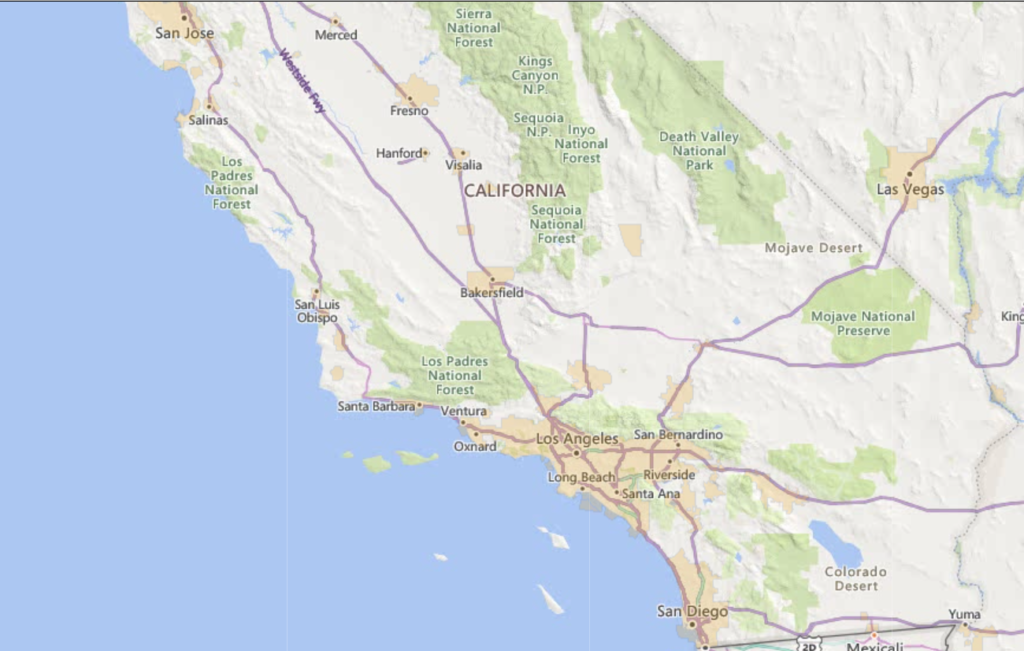

Geographically, a large majority of the land area in California is actually eligible for USDA loans, but the population centers are excluded. Eligible areas change from year to year as the population shifts and changes. Any areas on the maps below that are shaded in beige are ineligible.

You’ll see most of the San Francisco Bay area, San Jose, Sacramento, Los Angeles, Orange County, San Diego, and smaller cities in between are generally not eligible for a USDA loan. However, the outskirts of these metropolitan areas do have homes that are eligible if you’re willing to drive just a bit further.

Below are some eligible areas in Northern California.

- Crescent City, CA

- Davis Creek, CA

- Moonstone, CA

- McKinleyville, CA

- Humboldt Hill, CA

- Redway, CA

- Grass Valley, CA

- Placerville, CA

- Truckee, CA

- Rio Vista, CA

Below are some eligible areas in Southern California.

- Fallbrook, CA

- Borrego Springs, CA

- Yucca Valley, CA

- Joshua Tree, CA

- Big Bear, CA

- Wrightwood, CA

- Ojai, CA

- Solvang, CA

- Morro Bay, CA

- Paso Robles, CA

Household Income Limits

How does USDA define “lower” and “moderate” income? Each area has income limits depending on your household size. The more people that live with you, the larger your combined income can be. In many areas, the amounts are fairly generous. These are accurate as of February 2022, but keep in mind they do change from time to time, and are typically reviewed on an annual basis. The limits tend to increase rather than decrease each year.

The moderate income limit for 1-4 person households throughout California starts at $104,650 per year, and goes up to $238,200 in the San Francisco Bay area, with most areas falling somewhere in between.

What are the requirements if you already own a home?

If an applicant currently owns a home, additional requirements may apply. A new purchase can only be approved if your current home no longer adequately meets your needs.

• The applicant cannot retain a home that is currently financed with a Rural Development direct or guaranteed loan and the current home must not meet the applicant’s current housing needs.

• The applicant must agree to occupy the new home as their primary residence and the applicant must be without sufficient resources to purchase a home without the need for the guaranteed loan.

• The applicant may only retain ownership in one single family home in addition to the new home being financed with a guaranteed loan.

• If the applicant is eligible to retain their current home, they must be financially qualified.

• If the applicant has been renting the retained home for a minimum of 24 months and has a lease agreement to confirm the receipt of rental payments for a minimum of 12 months after loan closing, then the current mortgage liability may be omitted from the debt ratio calculation.