A Better Home Loan starts with

a Better Interest Rate

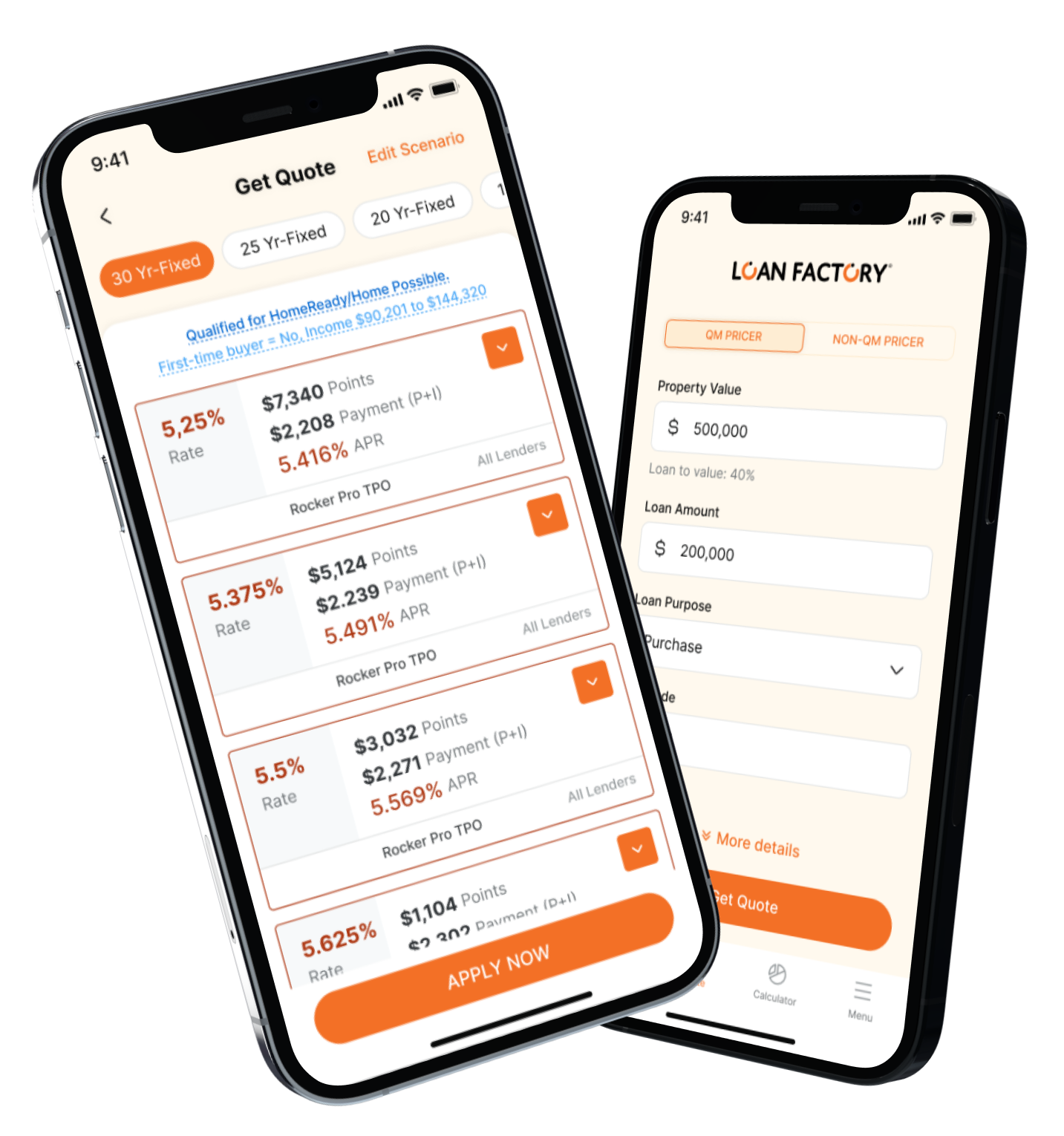

Quick Quote. NO SSN, NO Credit Check, NO Hassle, Start Here to Compare Rates >>>>>>

Stephanie Medellin

Loan Officer

We offer low mortgage rates along with a convenient online loan application process supported by a team of experienced loan officers.

Phone: (714) 603-9383

NMLS#: 876196

License: CA

Spoken Language: English

Mortgage Rates

Why are our rates so low?

- 1. WE SHOP RATES FOR EVERY LOAN: We compare rates from 240 lenders in real-time for you.

- 2. WE NEGOTIATE FOR YOU: Loan Factory is the fastest-growing Mortgage Broker in the United States. Because we have closed so many loans, we can negotiate and obtain ridiculously low rates from lenders.

- 3. WE LOWER OUR PROFIT: Our profit per loan is much lower than that of our competitors. We aim to earn your business and your referrals.

OUR ACCOMPLISHMENTS

240+

Number of Lenders

11265+

1751+

Ready to get started?

We are here to help you find a great deal.

Services We Offer

Home Purchase

Are you a first-time home buyer? We will guide you through the whole process from pre-approval to closing with our convenient and easy online application.

Refinance to a Lower Rate

Need to refinance to get a better rate or different terms? Refinance to put yourself in a better financial position. Rates are updated in real time from lenders so you can capitalize on a great opportunity.

Refinance to Get Cash Out

A cash-out refinance is one of several ways to turn your home's equity into cash. We will help you with your financial plan.

Rudy provided a great buying experience for me in purchasing a home in Monterey Park, CA. He knew the area well, provided excellent guidance, responded quickly when I had questions, and also help me negotiate a highly competitive house that was hot on the market. Thanks Rudy!

Aileen was a pleasure to work with, she helped us to buy a home which we were waiting for a long time. She goes above and beyond to get things done on time. Very prompt in follow ups, responding to emails and text messages. I strongly recommend Aileen if you are buying a house, you can rely on.

Michael is a professional and a gentleman. He was always on time; always prepared; always willing to go the extra mile. He answered all of our questions and provided details and explanations when we were puzzled. He was never flustered, never in a hurry, and never angry. Michael was a pleasure to work with. We are immensely satisfied with Michael's service.

Why Clients Choose to Work With Us

Fast funding,

easy application.

Get your loan today!

Quick Loans, Anytime, Anywhere!